Large dairy herds are growing rapidly in the UK, in terms of size and productivity while smaller outfits produced less milk due to the summer drought in 2017/18, compared to the previous year, according to the annual dairy costings report from Kingshay.

The figures – based on just shy of 2000 herds with 400,000 cows across the country – show that higher producing herds boosted milk output by progressively larger amounts – rising by 1.2% in the 0.5-1m litre bracket all the way up to a 5.1% increase in the more than 5m litre band.

Furthermore, not only have the highest producing herds boosted milk yields per cow, they have also grown in herd size by an average 17 cows, to 743 head in 2017/18 – a trend that can be seen in each of the past three years.

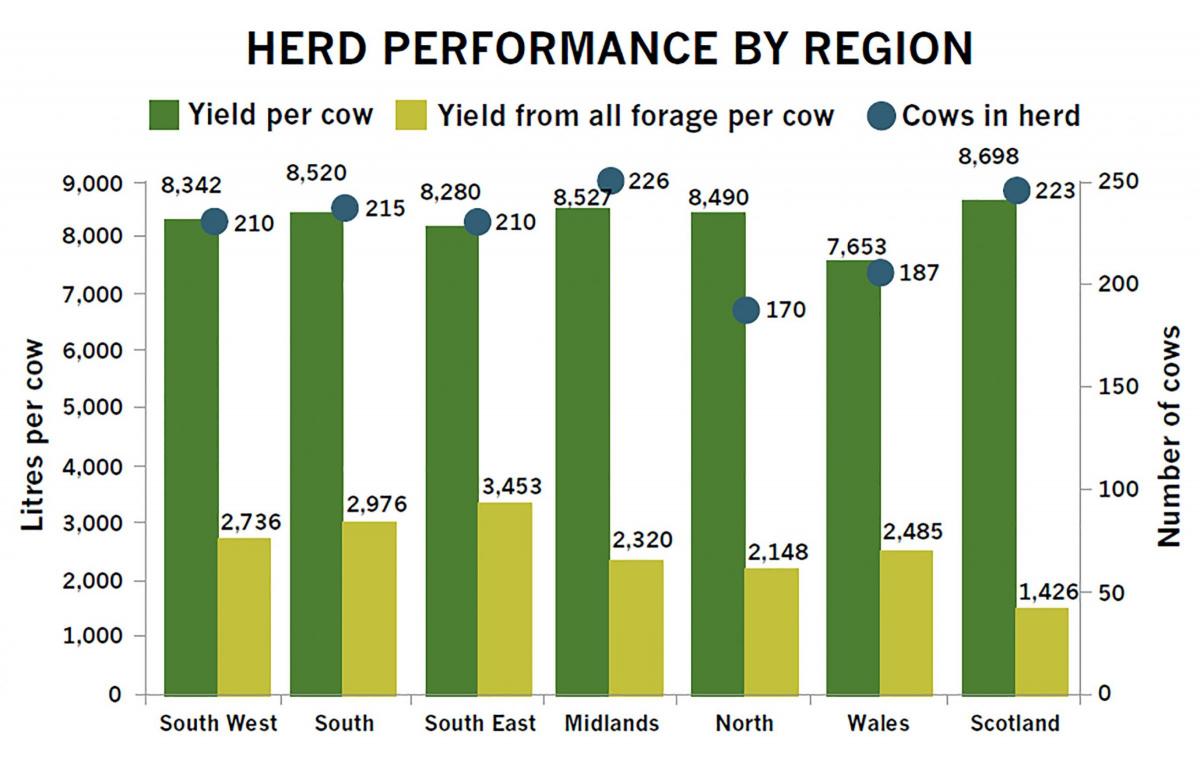

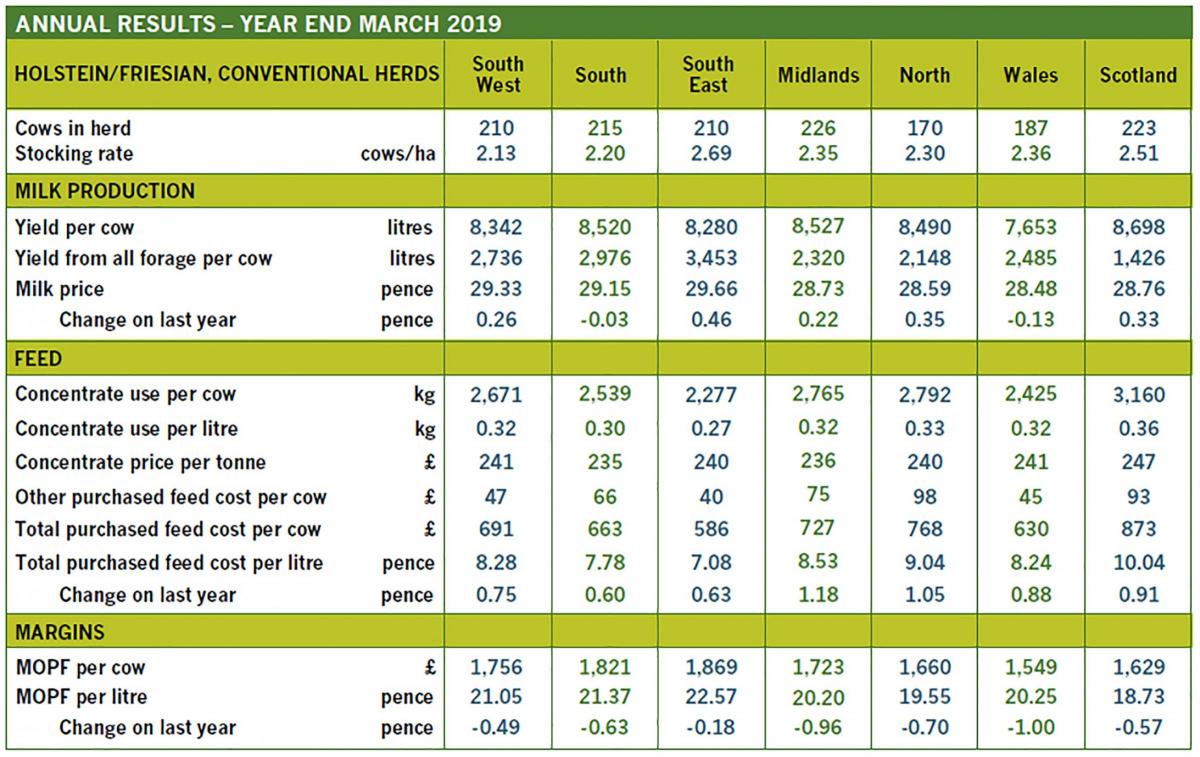

The report also showed Scotland boasted the highest yields at 8698litres per cow of all the regions due to its higher proportion of robotic herds and largest herd size at 223 head. However, it made the least use of forage and greatest use of purchased feed, which in turn eroded margins to 18.73p per litre – the lowest of seven regions. Margins per cow were nevertheless comparable to herds in other areas due to the increased milk yields per cow.

“Higher output herds are less reliant on grazing, so the summer drought had less of a negative impact than in lower output herds,” explained Kathryn Rowland, senior farm services manager at Kingshay.

“Larger herds are also more likely to be on aligned contracts, with a more stable milk price enabling a continued investment programme to increase output.

Margins increased steadily in line with overall herd production, from £1287 per cow in the smallest bracket, to £2120/cow in the largest group.

“In addition, the largest producers tend to benefit from improved efficiencies and clearly have an appetite for continued expansion,” she said.

The report shows that large herds have a disproportionately high impact on UK milk production with those producing in excess of 5m litres representing only 3% of Dairy Manager costings, and yet contributed 14% of the total milk sales. They also accounted for a massive 27% of the year-on-year increase in production across the whole pool, which Ms Rowland said could be an indication of processors and producers being driven by supply rather than demand.

Other notable trends showed the impact the 2018 drought had on production, culling rates and herd size, with the average herd size dropping for the fist time in 10 years, while culling rates increased from 27% to 29%, probably due to the lack of forage. Unsurprisingly, milk production from forage also fell to 29% of overall yields against 31% the previous year which was also a difficult season.

Despite the difficulties producers were able to boost yields by feeding more concentrates, with the report highlighting average yields increased from 8172litres last year to 8352, while concentrate usage rose from 2584kg/cow to 2683kg/cow.

Input prices in general also increased line in line with concentrate usage reaching a five year high in 2019.

Milk prices improved slightly over the same time too from 28.78p/litre to average 28.99p/litre. However, this is still not enough to offset the higher costs of production, the report claims which reveals the average margin over purchased feed has slipped from £1729/cow to £1713/cow.

Heat stress led to an increase in health issues for many herds last year too.

Looking at the top 25% of herds and the average, there is nevertheless huge room for improvement with combined savings of £13,836 per 100 cows with a better health status and up to £20,250 of savings per 150 cows in herds with improved fertility.

In Scotland,

Looking to the future, Ms Rowland warned: "Another dry summer, alongside high concentrate costs, means it’s vital to keep striving for marginal gains in health, production and expenditure, by benchmarking against the top producers to secure the same success. However, global dairy production is under pressure, which could maintain relatively firm milk prices. Overall there is optimism in the sector with a number of herds looking to re-invest,” she said.

P

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here