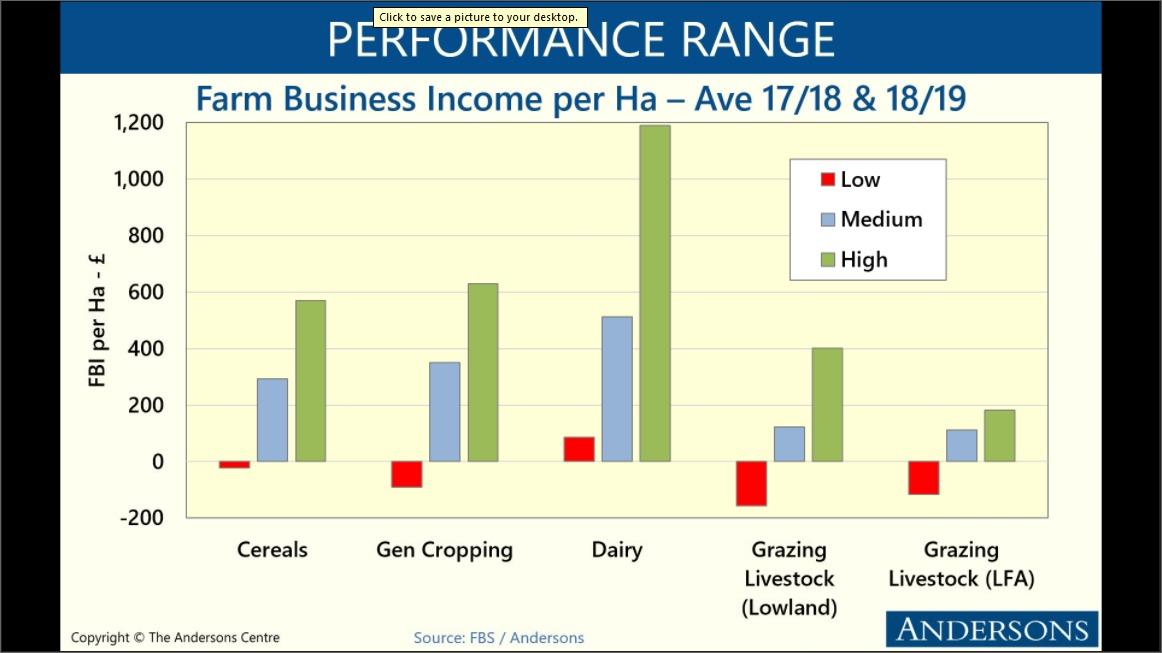

Basic Payment Scheme cheques are the main reason why so many beef and sheep farmers fail to produce the profit margins of their dairy, arable, pig and poultry rivals.

It is a situation that has arisen for years in all corners of the UK and while there are some extremely productive and profitable beef and sheep farmers, it is the larger percentage of under performing units both north and south of the Border, that pull the overall average for the sector down.

Hence, there is huge room for improvement according to Richard King, an agricultural consultant with The Anderson Centre.

"Beef and sheep farms end up looking bad because we show the average performance of farms in the sector and there are a large number of businesses in this sector and often smaller and/or inefficient, ones compared to other sectors," said Mr King who advises 2000 farmers throughout the UK.

While the BPS is the main one, high levels of support are also achievable through agri-environment agreements, which combined Mr King said: "Has effectively, allowed inefficient businesses to continue to survive."

Other reasons why productivity is so low on grassland units he said include:

• The barriers to entry are low, with capital requirements to set up and run a grazing livestock business lower than for other farming systems. It is also relatively easy to get access to sufficient land.

• There is less time commitment than in other sectors. As such, part-time farming is easier. Also, this type of farming is often seen as a retirement option – notably for ex-dairy farmers, but also for people coming into farming from a successful career elsewhere.

• Grazing livestock is often seen as a more ‘appealing’ way of life to many – there is not the 'tie’ of everyday milking or intensive management on an ongoing basis as there is with intensive livestock.

• Supply chains are open; anybody can have cattle and sell them at a market.

• Grazing livestock is useful if the desire is only to keep farms ‘ticking over’ such as by tenants who want to keep their house, or owner-occupiers who are staying on the farm for the tax advantages.

• These systems can operate in areas of the UK where other farming is simply not possible – notably hills but also poor lowland areas.

• Emotional attachment to the lifestyle for example herds and flocks are built up over generations with greater levels of personal ownership, especially for genetically pure breeds – i.e. people stick-at-it when logic suggests they should do something else.

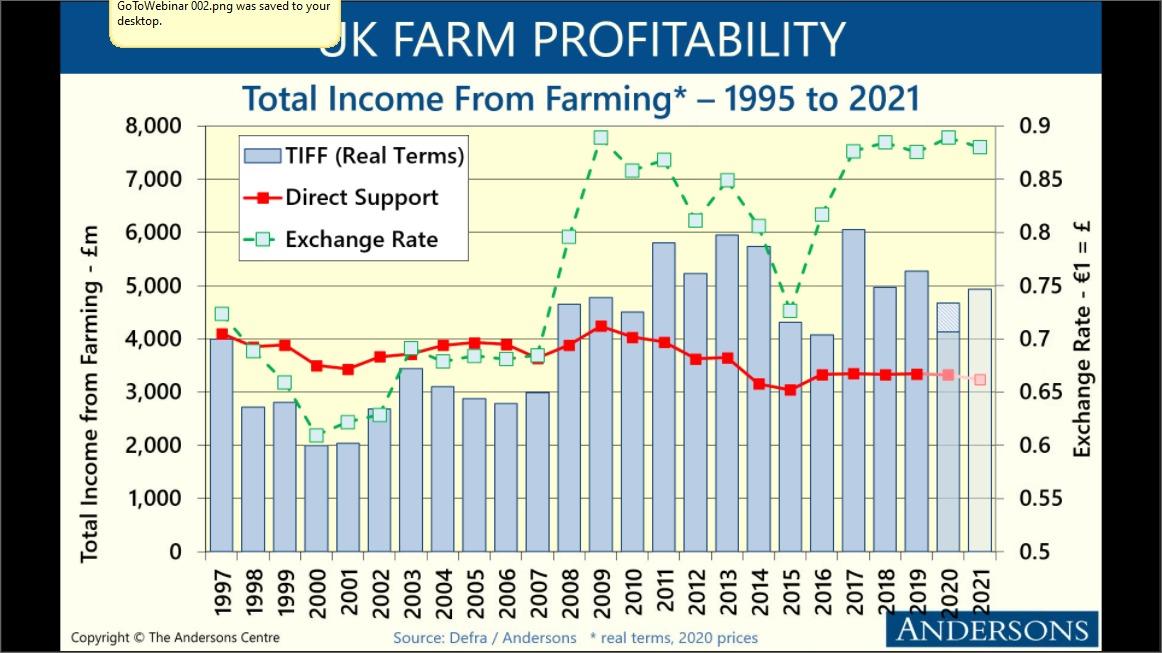

Speaking at the Andersons Centre Farm Profitability and Trade webinar, Mr King also highlighted that while Total Income from Farming (TIFF) had fallen over the past couple of years, it is not as low as it could have been, due to the fall in the value of sterling against the euro.

He also believes that with a UK/EU trade deal done, then profits could recover back towards the £5bn level as shown on the chart, albeit with considerable contribution of direct support (BPS + agri-environment payments) to UK farming profitability, again linked to the weak pound.

"Global Britain presents opportunities and threats – growing middle classes in non-EU regions, but harder to reach and the prospect of trade deals with lower-cost ‘agricultural powerhouses’ could undermine UK agriculture’s value proposition," said Mr King.

He added that the 2020’s are set to be a ‘transitional decade’ for UK farming. Brexit he said has already created the most significant change to the relationship with Britain’s largest trading partner in half a century and whilst the UK-EU TCA has prevented a cliff-edge, there will still be sizeable structural changes to supply-chains, particularly for perishable products.

"Multi-product and groupage shipments to/from the EU are much more difficult to undertake, particularly where export health certification is required.

"There are also ongoing difficulties with the NI Protocol which need very careful management and sensitivity, something which both the EU and the UK have fallen short on in recent months. All the while, the competitive pressure from non-EU countries will increase as Britain agrees trade deals elsewhere. This could arguably have as big, if not bigger, impact on the competitiveness of livestock sectors particularly," he warned.

However, given the population growth projections to 2050 and the rising global middle class, opportunities will also be created.

"If British farming is to fully exploit those, it needs to be clear on its unique value proposition, which in turn, needs to be safeguarded by policy (trade, agricultural policy and food standards). It is very difficult for any farming industry to develop new overseas markets if its competitive position is undermined domestically.

"We are at the early stages of the Agricultural Transition. A better and more competitive British farming sector can emerge, but it requires careful management and an aligned policy-making approach."

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here