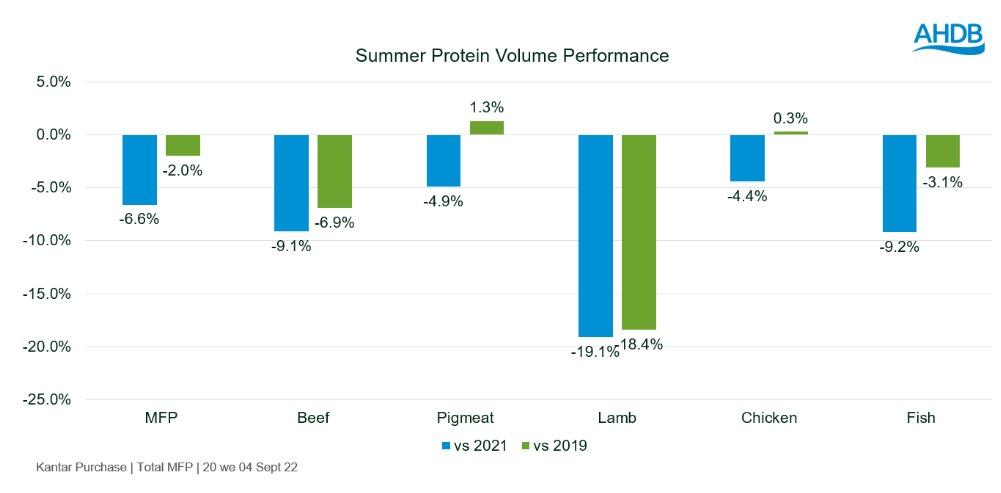

Inflation and the ever increasing cost of living crisis is having a worrying effect on the amount of protein consumed in the UK, with the latest report on volume sales for meat, fish and poultry down by 6.6%.

Huge changes lie a head too when the Institute of Grocery Distribution (IGD) predicts that the cost of food and drink is set to reach a peak rate of 17-19% year-on-year inflation in early 2023, before a slow run-down over the subsequent 12 months.

AHDB has nevertheless pointed out that food and non-alcoholic beverage prices rose to 16.4% in October 2022, suggesting the industry could have reached these levels sooner than expected.

As a result, the increased demand for practical dishes that are fast and easy to prepare looks set to continue, if the latest data from Kantar for the week ending September 2022, is anything to go by.

The figures for the summer months show chicken and pig meat remained firm favourites with both seeing slight growth on pre-pandemic volume levels from a total retail perspective. No protein was able to increase volume growth on 2021. Overall, the value of meat, fish and poultry grew by 1.5% in the summer of 2022, but, volumes declined 6.6%.

During this summer, 62% of pork servings – a record high – were made with practicality in mind. Versatility and price made pork a popular protein with sliced cooked meats, bacon and sausages making up more than 50% of share. Mince, burgers and grills saw strong volume growth versus last year, both up 10.8% based the latest data from Kantar.

Beef volumes saw a year-on-year decline of 9.1% with all cuts contributing to its negative performance. However, roasting, stewing and steaks were the worst performing cuts in the summer.

Beef burgers and grills are still a staple for summer, contributing 14.7% of beef volumes, the second most important cut after mince (23.7%). Both cuts are essential in holding up overall beef performance, with 6.1m kg of burgers and grills purchased during the average four-week summer period compared to 3.7m kg the rest of the year. Premium tier and branded burgers and grills saw significant year-on-year declines, with standard ranges holding steady, suggesting consumers are trading down towards more cost-effective options.

Mince made up 32.8% of beef occasions – an all-time high for summer – demonstrating mince’s ongoing importance as a budget friendly option.

Lamb has seen a massive 19.2% volume reduction versus last summer with almost every cut, apart from burgers and grills, down year-on-year. Burgers and grills saw a 0.5% volume increase versus last year, with some consumers switching from beef to lamb burgers.

In saying that, the evening meal made up 79.5% of lamb occasions, which is above pre-Covid levels, with the year-on-year growth of lamb meals labelled as a treat according to Kantar, suggesting consumers are searching for some form of indulgence as the cost-of-living pressure intensifies. This puts lamb in a good place to demonstrate itself as a suitable treat alternative from those out-of-home restaurant occasions.

Sales of dairy slipped back to pre-pandemic levels in the summer, following an uplift during lockdown. All dairy categories saw volume declines compared to the same time in 2021, with total dairy down 6.2%. This is a result of price increases, up 14.7% versus last year, and shoppers buying dairy less often. Alongside this, volumes sold through retailer promotions on dairy products saw a 27% decline.

Unsurprisingly, ice cream remains a firm favourite during summer – up 0.6% on last year, with growth in family tubs (+5%) and handheld ice cream (+2.3%).

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here