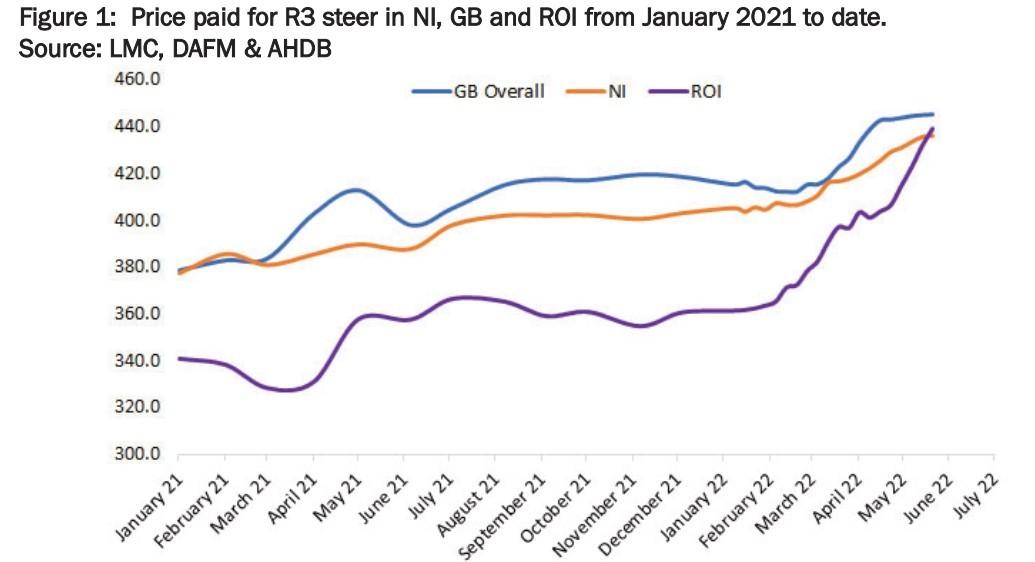

A worldwide shortage of beef is filtering through to the home markets with prices in the south of Ireland – traditionally where values are lowest compared to Northern Ireland and GB – soaring to new highs, with NI and GB hot on their heels.

Such has been the demand for beef in Europe and Eire, that deadweight cattle prices in the Republic of Ireland surpassed those in the North, in the last week of May, in all three R3 grade prime categories – the first time in more than five years.

Add in the increased demand for all cuts of beef for the Queen's Platinum Jubilee celebrations combined with the glorious weather last weekend, and fridge stores have been completely emptied leaving processors up and down the country scrambling to replenish stocks. As a result, several abattoirs significantly increased base prices on Monday by up to 8p per deadweight kg.

The trend looks set to continue too according to those in the know when trade in Eire for R3 steers for the final week of May was €5.26 (450p) per deadweight kg – up 11c/kg on the previous week – and higher than that of the same cattle in the UK and the EU at €5.19/dwkg and €4.98/kg, respectively.

Heifers in Eire have also seen huge increases, jumping 12c/kg on the week to €5.27/kg. This compares to the same week in 2021 when the R3 steer and heifer price were €4.13/kg and €4.16/kg, respectfully.

The figures from Bord Bia – the equivalant of AHDB and QMS in Eire – also reveal finished cattle numbers are tightening with strong competition between the processors for those available and signs of further improvement in the beef trade with 'exceptionally' strong prices seen for carcases.

According to the report, these soaring prices are a result of tightened supplies married with high demand for finished animals, as well as strong market conditions across Europe and the UK. Consumer demand remains good with the wider reopening of the foodservice market driving volumes higher.

Further afield figures from Rabobank point to beef production output in the States being down by 2.5% in 2022, due to increased slaughter figures following the drought and economic hardship across Western US in 2021.

Read more: Increased global demand for beef – need for £5/dwkg to ensure future supplies

Back home, the latest cattle population data from April 2022 points to higher supplies of cattle on farm in Scotland than a year earlier, according to Iain Macdonald, economics analyst at Quality Meat Scotland.

In particular, he pointed the remaining pool of spring 2020-born cattle, which have taken longer to finish, although numbers in the 18-24-month weight band were down slightly on a year before.

"After a dip in slaughtering in April and early May, in part down to the shorter holiday weeks, throughput at the price reporting abattoirs in Scotland picked up as May progressed to reach its highest of the year so far, potentially boosted by these additional spring-2020 calves.

"However, as we move into June, historical trends suggest that weekly availability begins to tighten as we start to run out of the spring-born calves from two years ago.

Commenting on the cow trade, he said: "Prices available to producers have been very firm and, in May, prices for R4L steers were only 10-11% higher than R4L cows compared to a gap of 28-29% in May 2021. While cull cow prices have been looking attractive to producers, evidence from slaughter statistics does not point to an elevated cow kill.

"At GB level, Defra statistics showed a 1.3% reduction in the cow kill compared to last year in the first four months of 2022, with March the only month to see a year-on-year increase so far. Meanwhile, data from recent weeks for the price reporting abattoirs and auction marts in Scotland does not suggest an unusually high cow kill for the time of year.

In the December 2021 census results published by the Scottish Government, revealed that while the number of beef cows continued to show year-on-year decline, the fall was less than 0.5% for the second year in a row, compared to declines of 1-2% between 2016 and 2019.

The rate of seasonal decline between June and December in 2021 was slightly stronger than in 2020, but remained below the levels seen in 2017-19. Nevertheless, a prolonged period of decline left the beef herd 12% smaller than a decade before.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here