Despite much improved finished values for both cattle and sheep, soaring costs of production are hitting farmers where it hurts most, with only the most efficient of farmers able to make ends meet.

Pointing out the stark reality that input costs are rising faster than finished beef cattle values which at present range from 418-420p per deadweight kg, Gavin Hill, senior business manager at SAC Consulting, said the market needs to remain well above £4 per kg to ensure a viable industry.

Read more: Top tips for beef finishing

“Finished beef cattle prices are up about £100 per head on the year, but when you consider feed costs are up 40p per head per day, the industry has taken two steps forward and two and a bit more steps back,” he told delegates attending an SAC Beef Finishing Maximising Returns open day at Easter Drumgley, Forfar, on Tuesday.

Gavin Hill Ref:RH161121058 Rob Haining / The Scottish Farmer...

“The market needs to remain strong, and above the 420p per dwkg mark in Scotland,” he said adding that with wholesalers and butchers in the north of England looking to buy well finished butchers cattle, an increasing number of producers are sending animals south.

“Depending on the type of cattle and the time of year, prices in the North of England can be 10p per kg above the Scottish average selling deadweight. Scottish farmers are also selling well finished cattle at Darlington where prices regularly exceed £2000 per head.”

While producers are unable to dictate finished prices, feed costs or the price of buying in store cattle, they were encouraged to concentrate on the physical and financial performance figures they do have control over.

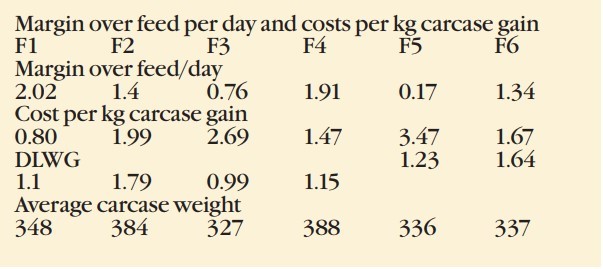

Lesley Wylie, SAC beef consultant, who set up a benchmarking group of six finishers in Scotland over the past year pointed out that increasing the average daily liveweight gain per day is key to improving margins.

Lesley Wylie

"Ensuring nutrition and health are on point will also help to improve performance."

She added that over the year, the six producers had cattle with average daily liveweight gains ranging from 0.99kg to 1.8kg, and feed costs of 53p to £1.89 per head per day.

The group comprised: F1 farmer who finished bought in steers and heifers on an intensive 100-day period on a diet made up of potatoes, silage and barley; F2 farmer who finished home-bred young bulls; F3 farmer who finished home-bred heifers on an intensive grain-based ration and F4 farmer who finished home-bred young bulls.

The two remaining farmers F5 and F6, both bought in steers and heifers, with the former using different feed systems depending on the time of year, grazing the lighter, younger animals and intensively feeding the older stronger stores. Farmer 6 bought stores in the spring, put them out to grass and finished them in the autumn/winter in house.

Read more: Wagyu beef: Warrendale has a plan to maintain standards

Feed costs were highest for those finishing intensively fed bulls and heifers, with F1 having the lowest costs, buying in a lot of waste product at much reduced values.

F5 had higher feed costs as he bought in a lot of grain and concentrates for feeding over a longer period of time.

Those buying in cattle bought stores ranging in price from £816 to £1126, with sale prices for all finishers working out at between £1197 and £1415, giving a buy/sell difference range of £289-£477.

Mortality was just over 1% for all three store finishers. There was no mortality post weaning noted in amongst the bull finishers or those with home-bred heifer.

Finished beef margins

NB F3 is feeding heifers from weaning to finish at around 18months – they are not outside again after weaning so have a long period of time on feed with quite a low DLWG which in results in a higher cost per kg carcase gain

F5 has high bought in feed costs and time of feed varies depending on bought-in weight of the animal and whether it is grazed or not.

Most farmers achieved gross margins higher than the QMS average, however it was F6 who buys in cattle, who produced the best. His heifers produced a gross margin of £190.08, having bought them in at an average price of £733 compared to QMS average of £826. The same farmer was also able to sell steers at a higher value than the QMS average at £1303 compared to £1159, leaving a gross margin of £143.28.

F1 produced steer and heifer gross margins of £92.97 and £89.32, compared to the QMS average of £69, with F2’s bulls leaving £73.85 against the QMS £73 base.

However, Ms Wylie added that the future profitability of the sector now has to be questioned when the drop in the store trade witnessed will ultimately put pressure on those farmers.

The event was funded by the University Innovation Fund from the Scottish Funding Council

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here