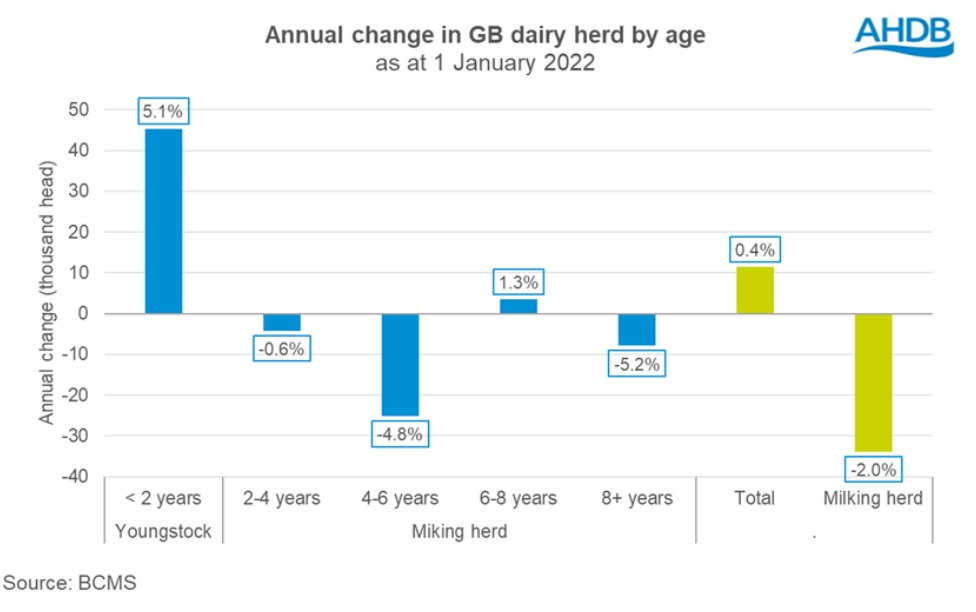

Dairy cow numbers have again slipped on the year, with the latest figures from BCMS showing a 2% decline at January 1, 2022.

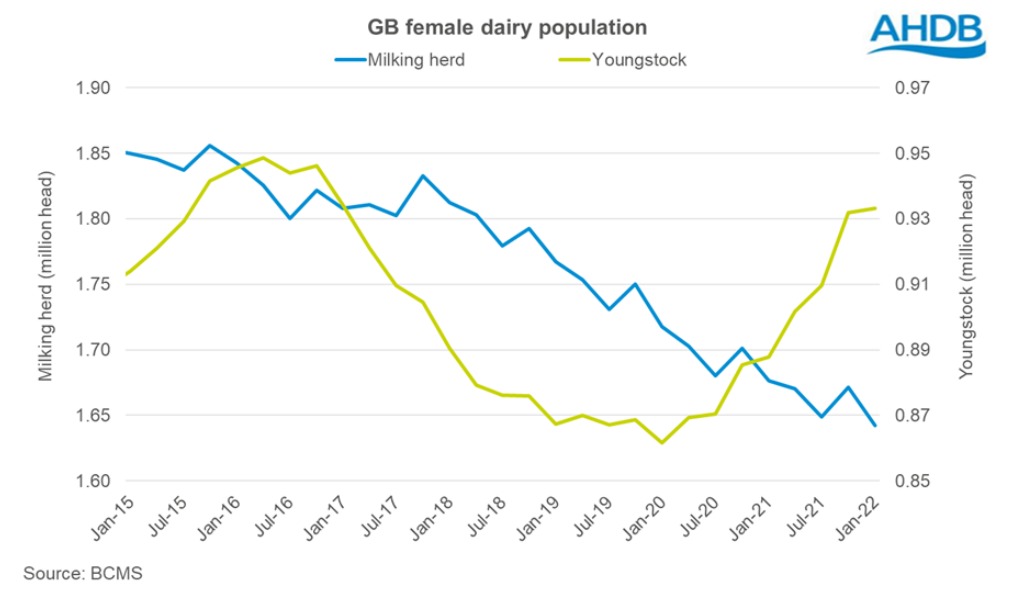

The figures show a GB milking herd down 34,000 head to 1.64m head, which continues the long-term trend of decline seen in the national herd.

GB milk yields are down on the year

Youngstock numbers under two years of age have been steadily increasing over the past two years with the current number 933,000 head, up 5.1% or 45,000 from the same time last year.

Youngstock numbers started rising early 2020, and will start ageing into the main herd this year. However, with ever increasing costs of production, farmers are unlikely to increase herd sizes according to a report from AHDB. Instead, the levy board believes less productive cows will be cleared to make space going forwards.

Looking further afield, global milk production is expected to continue to falling in the first half of 2022 despite higher farmgate milk prices.

In the latest Rabobank quarterly report, production is forecast to decline by 0.7% year-on-year for the first half of 2022 following a worse than anticipated end to 2021.

The main drivers are rising cost of inputs, lack of labour, unfavourable weather, and variable feed quality. It also goes without saying that the current geopolitical environment has escalated already high costs as Russia and Ukraine are key players in both the energy and the cereals markets.

GB milking cow numbers are down on the year

Exports are also expected to slow in 2022 as tight supplies reduce availability, while high prices may reduce appetite from importers. Lower demand from China is expected as their domestic production continues to grow, and stocks increase.

In the short term, Rabobank believes, dairy commodity prices should remain elevated as a result of inflationary pressures and tight supplies.

The longer-term view is difficult to predict due to uncertainties around consumer behaviour given higher prices, and market conditions in light of the impact of the conflict in Ukraine.

Despite this, there is little expectation that inflationary pressures with ease, or milk production grow, until later in 2022.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here