Despite unprecedented volatility in 2022-23, with record high prices across the board, from inputs to milk markets, dairy farmers did an 'excellent job' in securing record margins over purchased feed – albeit with some doing better than others.

That was the good news story from the annual Kingshay Dairy Costings Focus Report, on Monday, which revealed milk prices have increased by 61% over the past decade, reaching an average of 50.98p per litre in December 2022

However, with the gap widening between the top and bottom performing herds, Kathryn Rowland, senior farm services manager at Kingshay, said attention to detail at all times remains key to improving margins.

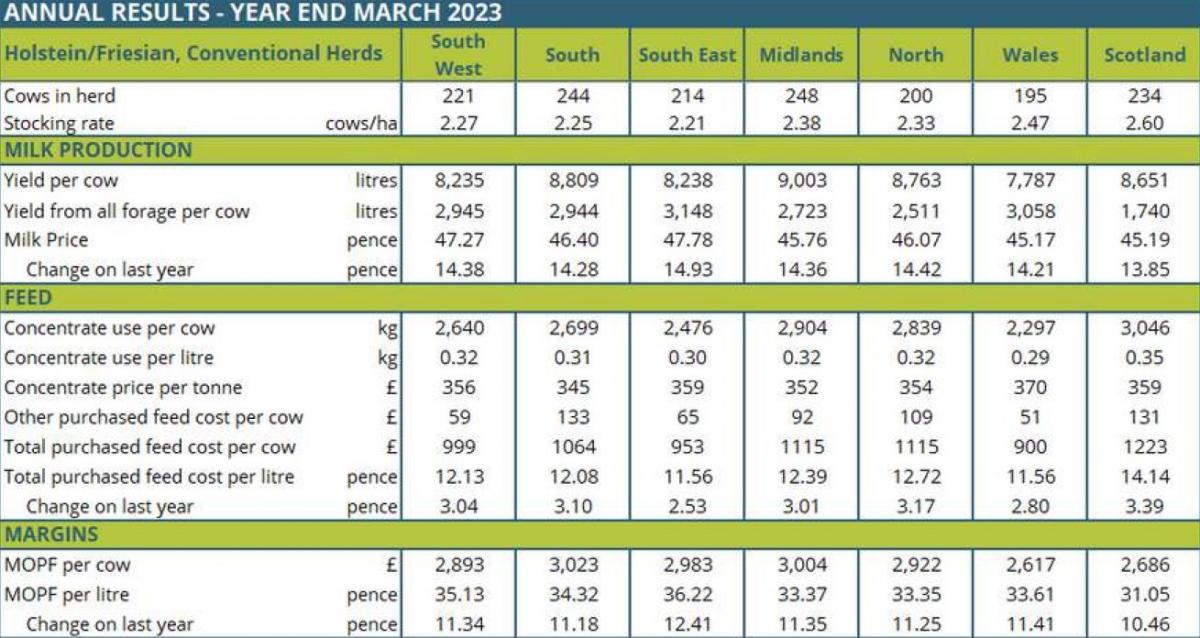

“The gap between the top and bottom 10% of prices reached a peak differential of 16.2p/litre in February, with producers in Scotland suffering the worst prices on a regional basis,” said Ms Rowland.

She added that the hot, dry summer of 2022 caused milk from forage to drop slightly, with many producers turning to feed winter forage stocks.

“The bottom 25% of producers used almost a tonne (917kg) more concentrate per cow than their higher performing counterparts, at 3197kg fed over the 12 months.”

Furthermore, not only did the summer impact yields, but fertility too.

“Cows didn’t display such obvious oestrus cycles due to the hot weather. As a result, days to first service increased from 69 to 75, and given the high milk price, the cost of each day of extended calving interval increased to £5.89/day per cow,” she said.

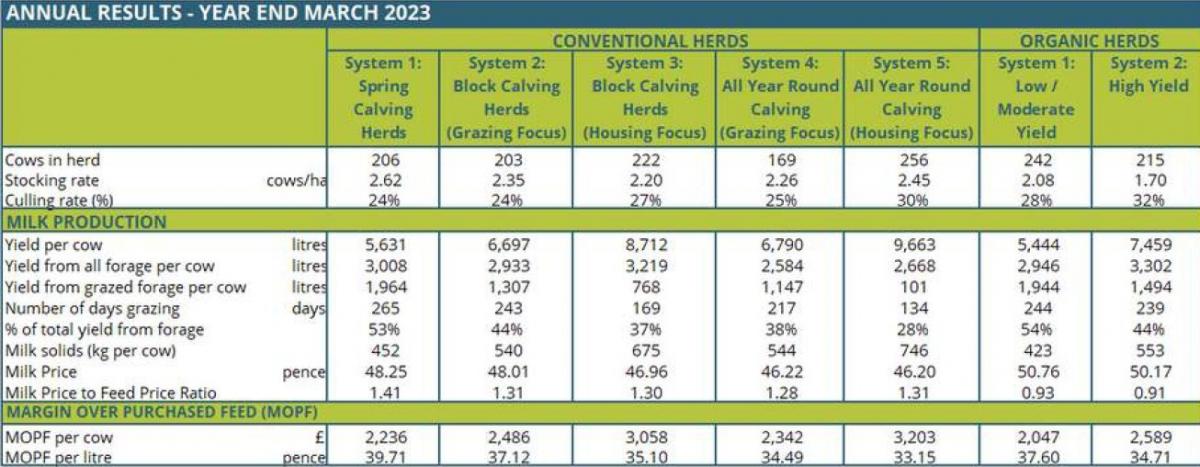

When comparing production systems, year-round housed cows produced the greatest margin per cow (but this higher margin needed to cover higher costs of production associated with housing systems), with low to moderate yielding organic herds leading on a per-litre basis.

“However, the gap between the top and bottom quartile of those within the same systems widened again, showing the potential to improve performance within an existing system rather than switching to an alternative.”

Heifer trends were new to the report this year and found 62% of herds in the report were not hitting the age at first calving target of between 23 and 25 months.

It was also found that 50.2% of cows leaving the herd are in their first three lactations and before they have fully paid for the cost to rear them which in turn can have a big impact on carbon footprints.

Herd size has grown by 23% over the past decade, although there was a dip in 2019 to 2021 when flying herds were not restocking due to high heifer prices.

“Since 2021, herd size has recovered its long-term trend, rising from an average of 201 cows to 217,” explains Ms Rowland.

Yields have also grown by 10% over the past 10 years, but over a shorter period have stagnated, remaining around 8400 to 8450 litres per cow since 2020, which Ms Rowland said could be due to a reduced focus on production alone, with a shift towards efficiencies and margins.

Milk from forage and grazing has also remained static since 2020, but over 10 years has grown by 31% and 9%, respectively. At the same time, concentrate use per cow has grown by 12%, with prices up by 46% to a record high of £357/t (rolling 12 month average). As a result, total purchased feed costs have jumped by 58% per cow and 44% per litre of milk produced.

“Thankfully, the milk price has increased by 61% over the same period – also to a record high – meaning the milk price to feed price ratio has widened by 10%, to 1.33,” says Ms Rowland.

“The larger the ratio, the better it is for farmers – and last year was the highest it had been since 2018.”

She also said the 10-year trend looks positive when it comes to the bottom line.

“The average margin over purchased feed improved by 86% on a per cow basis, and 69% on a per litre basis, to £2865 and 33.87p/litre, respectively – their highest levels since Kingshay first started the costings service back in 1998. A much needed additional margin to cover increases in all the non-purchased feed input costs,” says Ms Rowland.

Looking to the future, she encouraged producers to pay close attention to costs of production for the next 12 months, to assess the impact of high input costs, with accurate budgets essential for planning cash flow.

“Margins over purchased feed continues to be a key way to easily monitor production, feed efficiency and feed costs, along with milk quality and price each month, with comparisons to similar herds.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here