Dairy farmers have had a tough 12 months with soaring costs of production and poor milk prices, and ex-farm values are not going to alter much in the coming months.

That was the disappointing news delivered by industry commentator Chris Walkland, who in November had hoped the early months of 2024 would start to show some signs of improvement.

Speaking at the Semex Conference in Glasgow on Monday, he said that that while demand and consumption for dairy has improved slightly, so too has production with the result being spot milk prices remain unchanged. Therefore, Mr Walkland who boasts more than 25 years in the industry, expects ex-farm milk prices to remain below 40p per litre in the first half of the year.

“The International Farm Comparison Network (IFCN) is looking at 40-41p/l for mid-summer but my prospects for the next six months are nearer 37-38p which is not great, but the second half of 2024 should be better,” he said pointing out that the industry is unlikely to see a return of Mr High Milk Price this year but a Mr Higher Milk Price in the second half of 2024.

Mr. Walkland added that the markets appear lacklustre and costs of production still remain relatively high, while the Global Dairy Trade Auction remains neutral, futures are uninspiring and exports to China are slim.

Commodity values remain pretty stable too, with butter at £4800 per tonne; cream at £2.05-£2.10/kg; Mozzarella at £3300/t, and mild and mature Cheddar at £3600/t and £3800/t respectively.

Current and estimated futures prices for such commodities are also poor with EU butter and skimmed milk powder at 35.50p; EU futures at 35.32p; UK Cheddar, 35.78p; trader Actual Milk Price Equivalent (AMPE) at 33.55p and trader Milk for Cheese Value Equivalent (MCVE) at 35.50p.

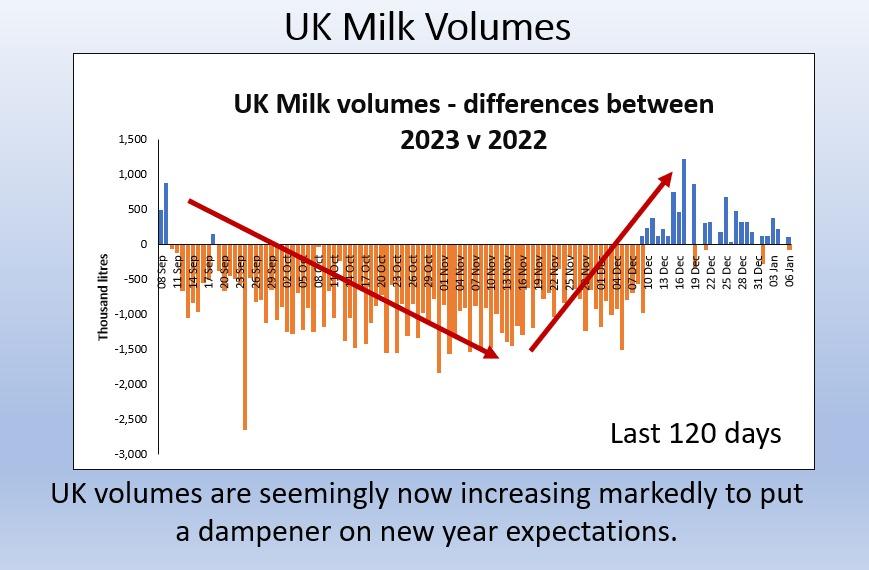

In contrast to last year, production figures are also on the rise in the UK and in Europe, due to the mild weather in December and producers holding onto cows just to get more money in the bank – despite the low prices paid.

On a more positive note, Mr Walkland said dairy price inflation is falling fast which could ramp up demand and the sector is particularly good at selling products abroad.

“Dairy is the best sector of all at exporting. Don’t underestimate how good you are as individuals or as an industry, because it can all change very quickly,” he said.

José Nobre, CEO of Ab-Agri also believes more investment should be put into exports.

He said dairy is one of the major solutions for UK health and nutrition and could also be for much of the world.

He added that while milk consumption fell by 11.7% in the UK and the EU; by 6.7% in the US and by 22% in Oceania; demand for dairy has increased markedly in Africa, Asia, and Latin America by 13.1%, 56.1% and 4.6% respectively.

“The challenge is to feed a population of more than 8bn people in the world and dairy provides affordable nutrition. It is the most nutrient dense food and in the UK, producers are way above the average when you see milk yields here are 8140kg against the global average of 2577kg.

“Up to 10% of the world’s population is undernourished and that rises to 20% in Africa. Dairy is affordable and here in the UK there is so much potential to export.”

However, he warned that to increase production further, the amount of forestation would have to be reduced when 31% of land use in the UK is covered by trees, and permanent pasture and meadows account for just 24%.

“The planet cannot survive without ruminants when 86% of global livestock feed intake is made up of materials which cannot be utilised,” concluded Mr. Nobre.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here