Dairy profits are likely to come under increasing pressure in the coming year despite a relatively stable period of trading up to March 2021.

That was the warning from Promar Farm Business Accounts (FBA) following its most comprehensive analysis of actual dairy farm financial performance available in the UK.

Neil Adams, managing director of Promar International, said the results give valuable insight into farm performance and opportunities for improvement.

“The year to March 31, 2020, was a rather benign year for dairy farmers, in part due to the reduced impact of Brexit and in part due to the pandemic. Farmers generally were unable to complete investment projects and overall just spent less.

Read more: Dairy profits hit £185/head – Milk Cost of Production report

“This resulted in a better financial year for the sector with average profit per cow rising by £33. This was due to a combination of a small increase in output combined with costs control across many areas, resulting in overall lower costs.”

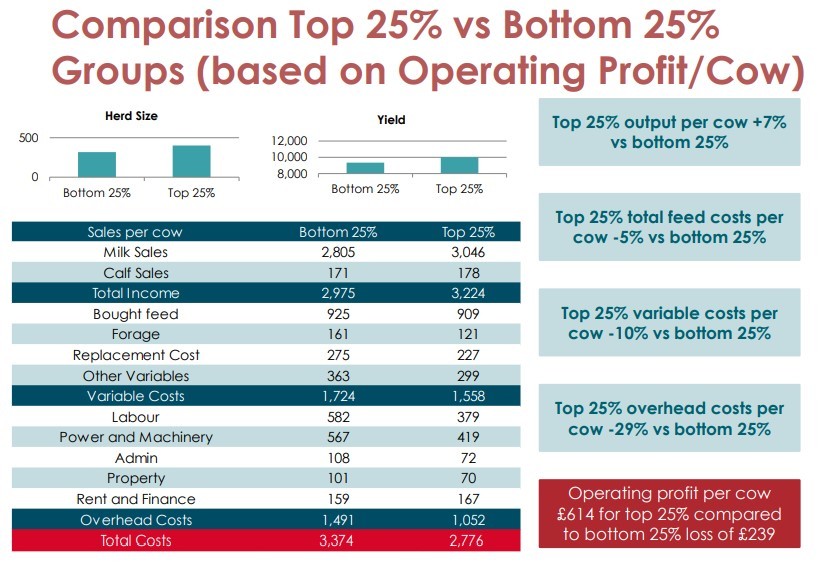

He added that there remains a considerable range in financial performance within the sample. While the average farm made an operating profit of £226 per cow, the top 25% selected on operating profit per cow achieved a profit of £614 per cow. They achieved a higher output per cow while managing to control all costs better and managed bigger herds.

Difference between the top and bottom 25% of dairy herds

“The real concern at present is the significant price increases seen in many major farm inputs. Wheat and soya prices have risen 26%, electricity by 76% and oil by 100%. We are also seeing major hikes in fertiliser prices.

"Indirectly, the higher energy prices and the rising cost of transport will work through to other costs increases. In addition it is likely that interest rates will increase, and all farms are having to react to reductions in Single Farm Payment.

“Not all these will work through to affect profitability in the year to March, 2022, but will certainly have an impact in the year to March, 2023. Based on the FBA data, we estimate that costs will rise 2.2ppl in the year to March, 2022, and another 3.2ppl to March, 2023, an average increase of 5.4ppl.

Mr Adams acknowledges that there are still a number of uncertainties about exactly how prices will develop and suggested global feed stocks may improve, helping moderate the effect on prices. Milk prices, he said, are also showing signs of improvement.

“It is vital farm businesses assess the likely repercussions for their business which will depend on the system. For example, an intensive system will be more at risk of energy price increases than a more extensive operation.

“We would urge all dairy farms to budget and plan in detail and to understand the impact of changes in each cost Then they can determine the gap they need to fill and assess marginal costs and challenge every aspect of their system,” Mr Adams concluded.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here